kern county property tax rate

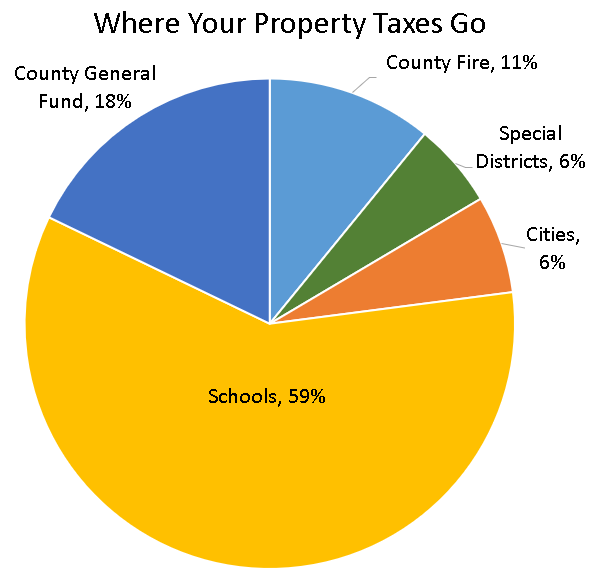

Property statements provide a basis for determining property assessments for fixtures equipment and taxable personal property. In Kern County property tax is used to fund the county government schools and other public services.

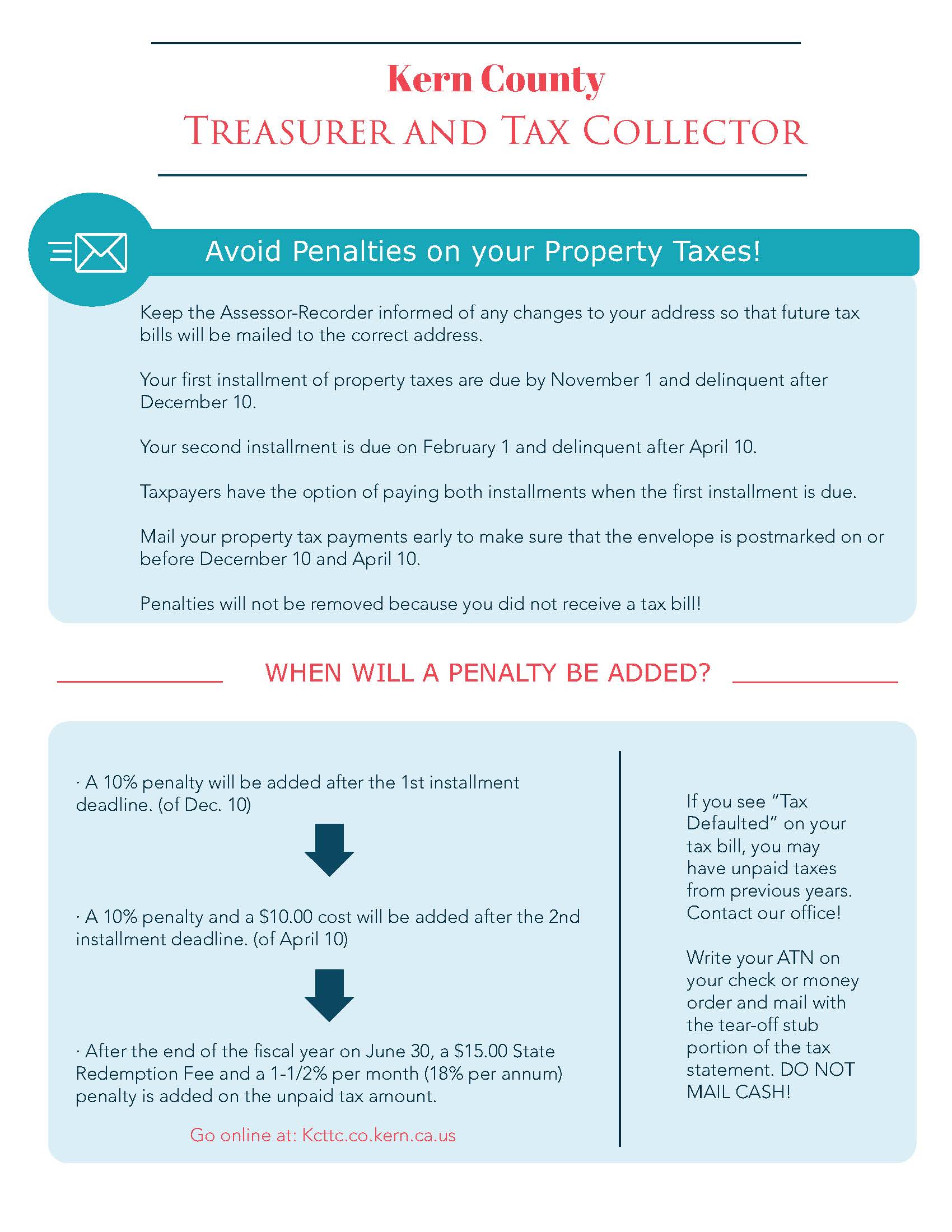

Kern County Treasurer And Tax Collector

1 be equal and uniform 2 be based on current market worth 3 have one estimated value and 4 be considered taxable if its not specially exempted.

. Auditor - Controller - County Clerk. Taxation of real property must. Cookies need to be enabled to alert you of status changes on this website.

Kern County CA Home Menu. Request Copy of Assessment Roll. Tax Rate Areas Kern County 2022.

Assessment-Appeals Clerk 1115 Truxtun Ave 5th Floor. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of. Establecer un Plan de Pagos.

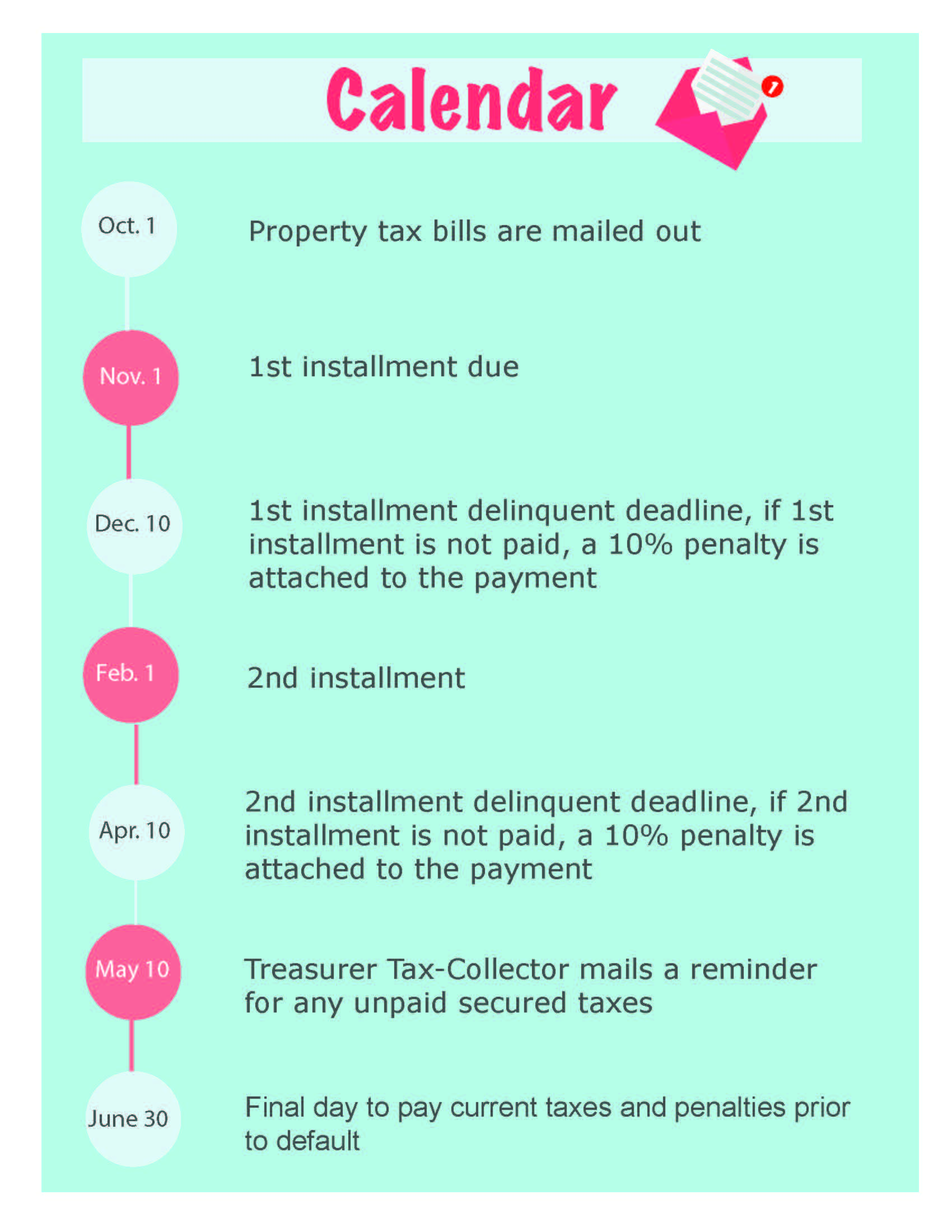

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools. Election to Establish an Installment Plan. Information in all areas for Property Taxes.

Application for Tax Penalty Relief. 1115 Truxtun Avenue Bakersfield CA 93301-4639. Clerk of the Board Attn.

Further information regarding the appeals process can be obtained by calling 661 868-3485 or in writing to. Request For Escape Assessment Installment Plan. Visit Treasurer-Tax Collectors site.

Senate Bill 813 enacted on July 1 1983 amended the California Revenue and Taxation Code to create what are known as Supplemental Assessments. 800 AM - 500 PM Mon-Fri 661-868-3599. Please select your browser below to view instructions.

1115 Truxtun Avenue Bakersfield CA 93301-4639. This law requires that any increase or. In Kern County the average property tax rate is 08 making property taxes slightly higher than the state average.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Property Taxes - Assistance Programs. The Kern County Sales Tax is collected by the merchant on all qualifying sales made within Kern County.

Property Taxes - Pay Online. Groceries are exempt from the Kern County and California state sales taxes. Kern County collects on average 08 of a propertys assessed.

This means that residents can expect to pay about. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. Auditor - Controller - County Clerk.

Please enable cookies for this site. 2001-2002 Annual Property Tax Rate Book. In Kern County California a home worth 217100 pays a median.

Stay Connected with Kern. Businesses with personal property and fixtures.

Kern Co Weighs Levying 1 Cent Sales Tax On Unincorporated Communities

Los Angeles County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

Study Oil And Gas Industry Contributed More Than 197m To Kern County Last Year

Kern County Assessor Recorder S Office Bakersfield Ca

Kern County Sheriff Dispatch Log Fill Out And Sign Printable Pdf Template Signnow

Kern County Treasurer And Tax Collector

Kern County Auditor Controller County Clerk

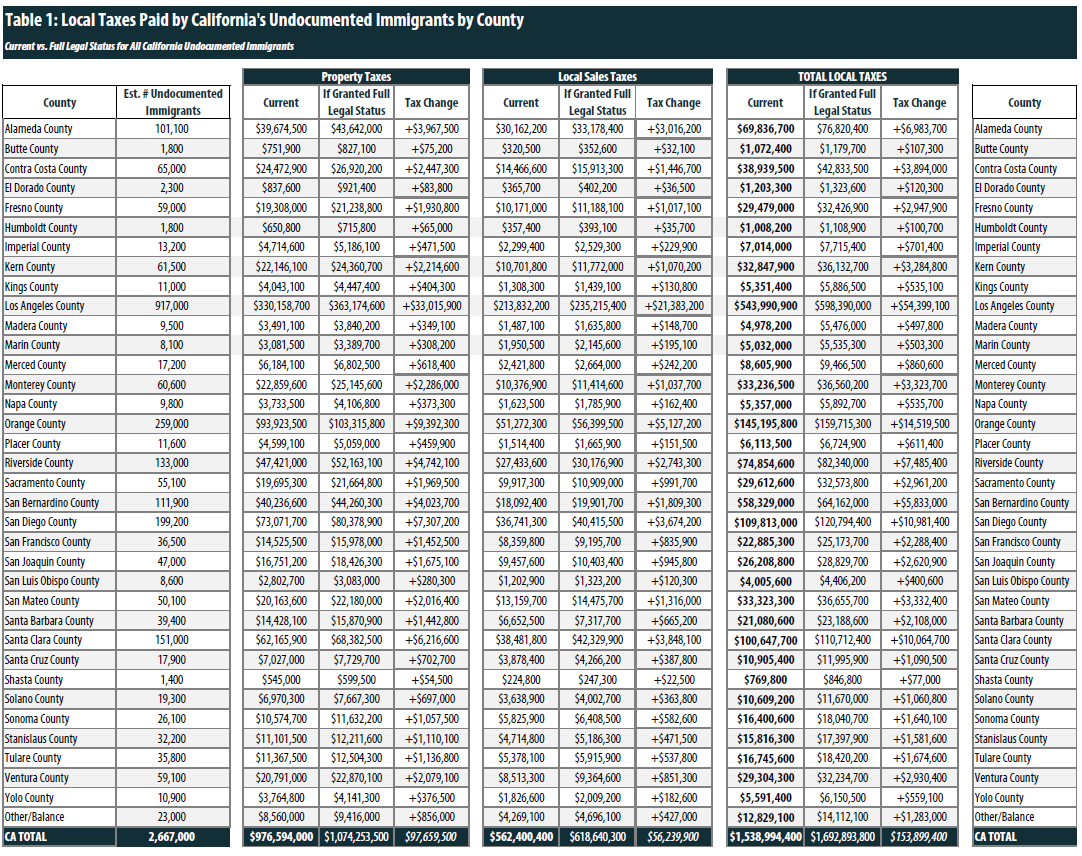

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

County Sees Uphill Road To 1 Cent Sales Tax Increase News Bakersfield Com

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

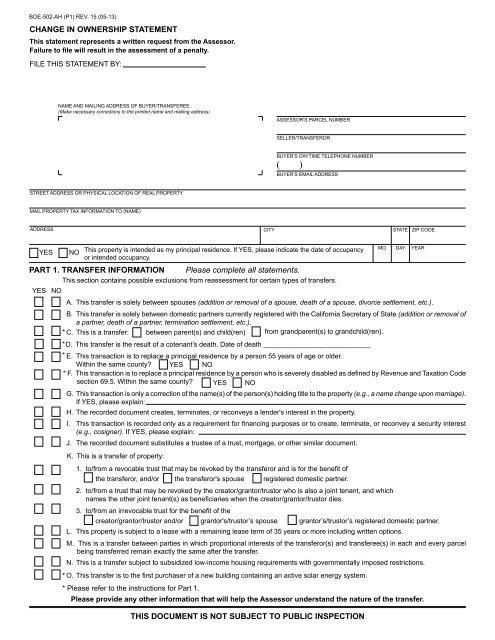

Preliminary Change Of Ownership Report Kern County Assessor

Medi Cal Kern County Ca Department Of Human Services

Kern County California Fha Va And Usda Loan Information

Kern County Assessor Taxable Property Values Increased 11 7b Versus Previous Year Kern Valley Sun