wichita ks sales tax rate 2019

If the fractional basis is used each lot in. In 2019 it was 32721 based on the Sedgwick County Clerk.

Kansas Is One Of The Least Tax Friendly States In The Us Kake

The minimum combined 2022 sales tax rate for Wichita Kansas is.

. The total sales tax rate is 75. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. 3 lower than the maximum sales tax in KS.

Kansas is one of only 14 states to tax food and among only seven states that tax food at the full sales tax rate. In Wichita the local sales tax rate is 1 for Sedgwick County. Aug 18 2021 des moines voters approved a 1 percent local option sales tax in 2019 bringing its total sales tax rate to 7 percent.

Des Moines voters approved a 1 percent local option sales tax in 2019 bringing its total sales tax rate to 7 percent. For tax rates in other cities see Kansas sales taxes by city and county. No tax rate should ever go up.

The average salary for a Retail Sales Associate in Wichita KS is 23500 per year. As of the 2020 census the population of the city was. Kansas Department of Revenue website.

This is the total of state county and city sales tax rates. These insights are exclusive to Mint Salary and are based on 114 tax returns from TurboTax customers who reported this type of occupation. A 500 fee will be applied to each transaction handled at any of the Tag Offices.

As of 2019 946 of Wichita KS residents were US citizens which is higher than the national average of 934. 1-22 2 KANSAS SALES TAX. The 65 state plus a 145.

There is no applicable city tax or special tax. If you have any questions regarding sales tax exemption please contact Loretta Knott at LKnottwichitagov or by phone at 316-268-4636. Total Property Tax Rate.

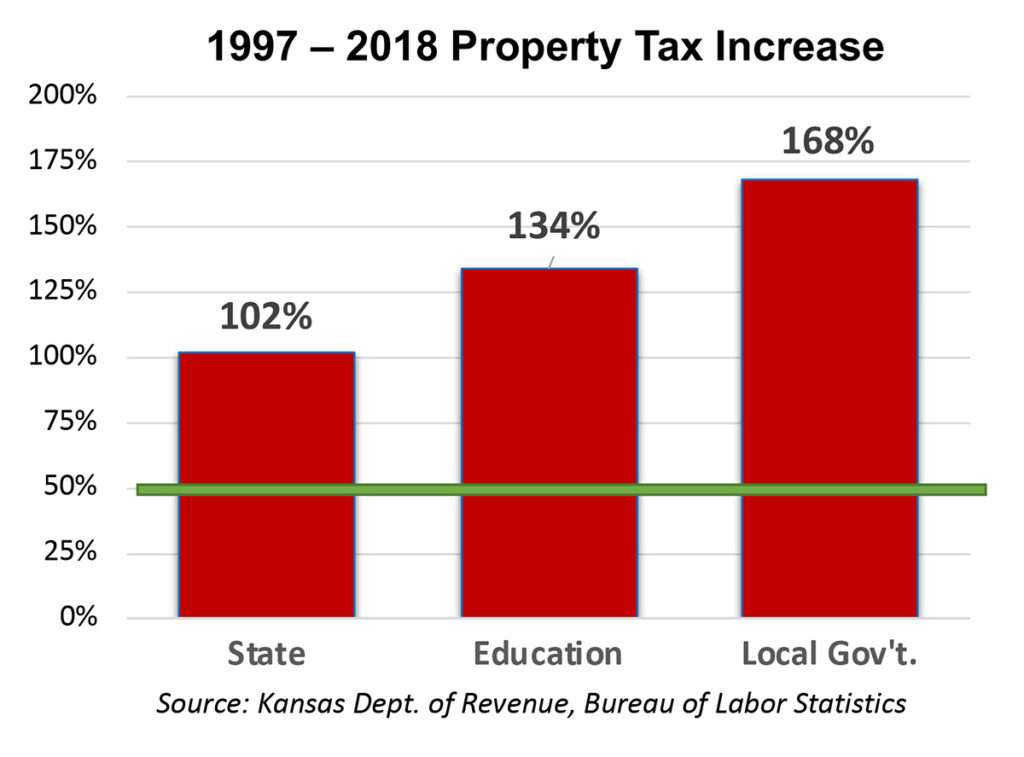

To raise the tax rate is an indicator that government is growing at a faster rate than the privet sector or is doing a very bad job at spending our money. Neighboring Missouri taxes food at a. The Wichita sales tax rate is.

An Anytown KS resident goes to Missouri to purchase a laptop computer during a Missouri sales tax Holiday The cost of the computer is 2000. Average Sales Tax With Local. Tax rate of 525 on taxable income between 15001 and 30000.

Tax rate of 31 on the first 30000 of taxable income. The most common methods of assessment are the square foot basis and the fractional basis. Taxes in Wichita Kansas are 138 more expensive than Rhome Texas.

Thats an increase of 1431 mills or 457 percent since 1994. Tax rate of 31 on the first 15000 of taxable income. Kansas has state sales.

About our Cost of. 31 rows The state sales tax rate in Kansas is 6500. Therefore larger lots will pay more than smaller lots.

The Kansas sales tax rate is currently. Retail Sales Associate salaries in Wichita KS can vary between 16000 to 40000 and depend on various factors including. Above 100 means more expensive.

3 Local Sales Tax Distribution of Revenue. There may be additional sales tax based on the city of purchase or residence. The County sales tax rate is.

Wichita City Council is raising the sales tax from 75 to 95 - a 27 increase - in a community improvement district near the new baseball stadium and on the east bank of the Arkansas River. Compare sales tax rates by city and see which cities have the highest sales taxes across the United States. For married taxpayers living and working in the state of Kansas.

The rate in Sedgwick County is 75 percent. Kansas asks that you file for your sales tax license 3-4 weeks before you plan to start actually making sales in the state. Iowa also 1 percent.

142063 mills 2018 City. 100 US Average. USD 259 Wichita Schools.

The gross receipts tax is much like a Value Added Tax only for businesses rather than individuals. Jonathan Silvey - June 18 2020. These are for taxes levied by the City of Wichita only and do not include any overlapping jurisdictions Wichita mill levy rates.

Check out this handy publication for instructions on registering your business in Kansas. With local taxes the total. - Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home.

Four states impose gross receipt taxes Nevada Ohio Texas and Washington. Sedgwick County Appraiser website. PDF to see established fees and charges effective October 2019.

The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. Below 100 means cheaper than the US average. And local sales tax rate for Finney County outside the city limits of Garden City is 795.

Tax rate of 57 on taxable income over 30000. 5 rows Kansas sales tax changes effective July 1 2019. If the square foot basis is used each property owner will be responsible for a share of the project cost relative to the square footage of hisher lot.

Collect Retailers Sales Tax. At the same tax rate government revenues would increase at the same rate as prices incomes and property values. 679 rows Kansas Sales Tax.

New sales and use tax rates take effect. You can print a 75 sales tax table here. And the seller does not charge a sales tax rate equal to or greater than the Kansas retailers sales tax rate in effect where the item is delivered or first used.

Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr.

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

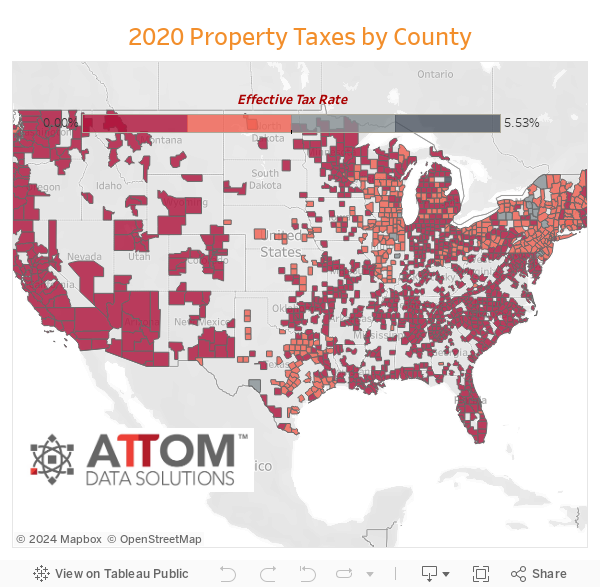

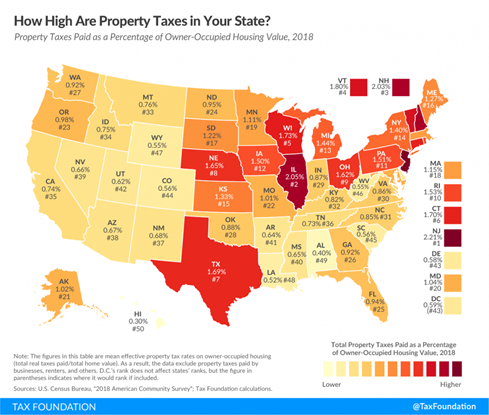

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

File Sales Tax By County Webp Wikimedia Commons

States With Highest And Lowest Sales Tax Rates

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Kansas Food Sales Tax Kc Healthy Kids

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Kansas Food Sales Tax Kc Healthy Kids

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

States With Highest And Lowest Sales Tax Rates

Gov Laura Kelly Promises To Sign Bipartisan Bill Eliminating Kansas Sales Tax On Food By 2025 Kansas Reflector

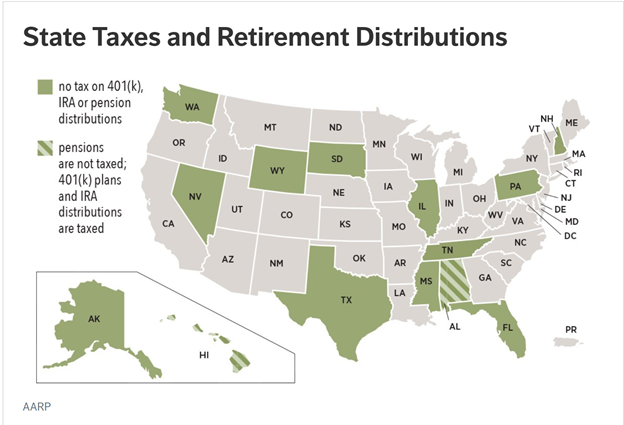

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute